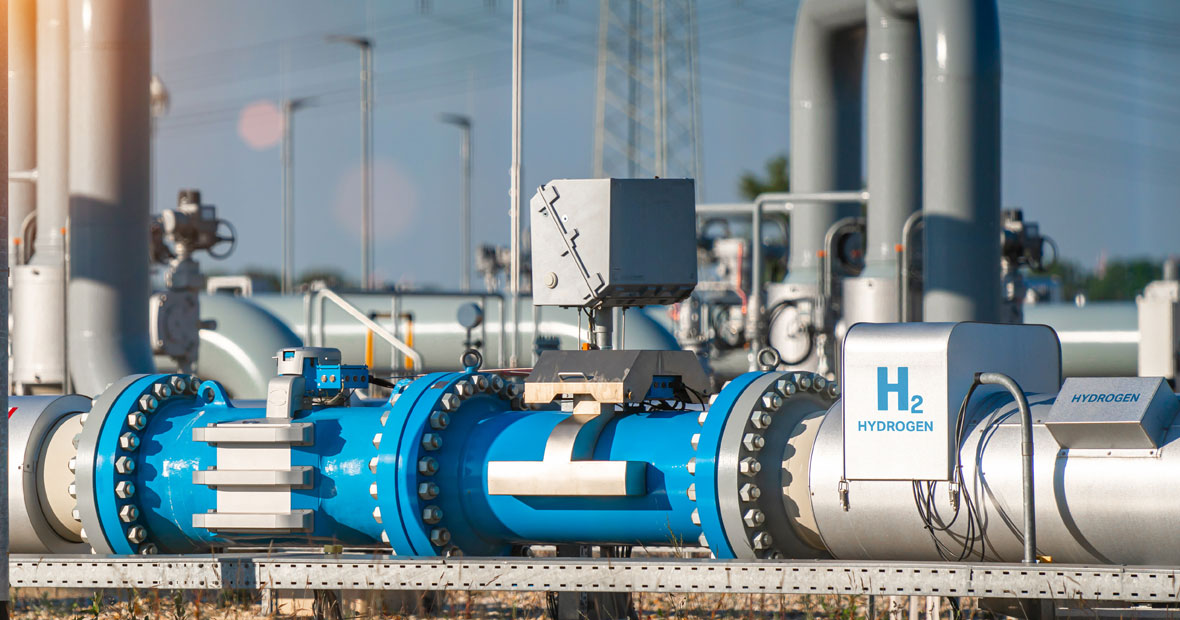

There can be little doubt that hydrogen energy constitutes one of the most clear-cut paths to a more sustainable future. However, the adoption of hydrogen-based technologies has not yet become widespread despite some significant progress in the sector. For example, India recently announced its first-ever public bus service that will run exclusively from a green hydrogen fuel cell. At the same time, the Japanese carmaker, Toyota, also unveiled its latest fuel cell prototype which it expects to become the norm in its sedan car production within 10 years. Given these developments, what does the latest hydrogen news say about the sector and its potential for playing a more significant part in a sustainable future for the planet?

Investment in the Hydrogen Sector Looks Strong Overall

According to the latest International Energy Agency (IEA) report into hydrogen energy, commercial interest in the sector remains strong. Over 40 countries across the globe have set out national hydrogen energy strategies and the deployment of electrolyser capacity is beginning to gear up. The good hydrogen news is that up to 2GW of energy production is expected to come from electrolyser hydrogen systems by the end of the year, based on projects that have been given the green light from investors. To put this in context, this is up from a mere 700MW of hydrogen energy production at the end of 2022. Current investment levels suggest that around 420GW could be produced from sustainable hydrogen by the end of the decade. As more governments invest in their own plans for hydrogen to play its part in their Net Zero commitments, so prices are expected to drop, meaning that widespread adoption will subsequently become more likely in the private sector.

Investment Challenges to the Adoption of Hydrogen Technology

Despite the strong momentum building behind hydrogen as a clean-burning fuel, there are some significant issues that still need to be overcome to secure a more sustainable future. For one thing, the major player in the hydrogen technology market today is China. Given the nature of China's economy, any watering down of the Chinese government's commitment to hydrogen could have a disproportionate impact on the sector as a whole. In the West, investment decisions in hydrogen-based technologies have frequently been deferred, however. This is often because of inflationary pressures and economic stresses related to global factors outside of the renewable energy industry as a whole. According to one report, some 80 per cent of hydrogen technology projects were yet to receive their final investments in 2023. As a result, the increase in hydrogen-based energy capacity, though on an upward trend, might not achieve the previously expected targets.

What's Needed to Bridge the Sustainability Gap?

The IEA and others in the industry have been keen to highlight the sustainability that hydrogen-based forms of energy can offer the world. From hydrogen cars, buses and commercial vehicles to stand-alone electrical generators that can serve the grid or act as a green back-up for the energy demands of critical infrastructure, like hospitals, in the event of a power outage, hydrogen clearly is going to be part of the energy mix. Nevertheless, industry commentators have pointed out that a lack of investment at such a key stage for the sector is only likely to push future costs up. What the industry is seeking, therefore, is more certainty from its backers in both the public and private investment sectors. Only with 'bolder action', as the IEA put it, will demand be stimulated for hydrogen fuel cells which, in turn, will begin to bear down on costs as economies of scale start to take their effect. If the IEA is right and further funding for the hydrogen industry can be secured in the short to medium term, then this technology is, indeed, likely to help bridge the gap the world currently faces between its need for energy and environmental sustainability.